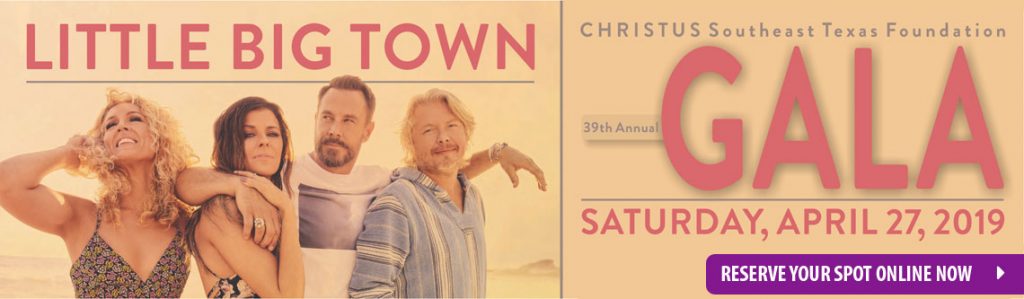

It’s that time of year again! Join us this year for the 39th Annual CHRISTUS Gala starring Little Big Town. Little Big Town has earned over 35 award show nominations and in the past five years has taken home nearly 20 awards, including multiple Grammy, CMA and ACM awards, and an Emmy award. Little Big Town are nominated for best country duo/group performance for this year’s 2019 Grammy for the song “When Someone Stops Loving You.”

Each year, the CHRISTUS Southeast Texas Foundation continues to raise the bar by offering world class entertainment, five-star cuisine, and elegant ambiance. Past CHRISTUS Gala entertainers include Keith Urban, James Taylor, Reba McEntire, Don Henley, Aretha Franklin, and Harry Connick, Jr., just to name a few. The much anticipated and always exceptional Gala brings the community together to celebrate the CHRISTUS mission of extending the healing ministry of Jesus Christ.

The black tie benefit provides an opportunity for an intimate evening of entertainment starting with cocktails and hors d’oeuvres at 7 p.m. followed by a gourmet meal at 8, all leading to the Little Big Town performance at 9:30. Tables for eight start at $3000 and individual seating starts at $375. Seating is limited and expected to sell out quickly.

The proceeds from the Gala go towards funding life-saving equipment for CHRISTUS Hospitals in Southeast Texas. Past galas have helped raise funds for major medical equipment such as 3D Mammography and Cancer equipment.

Joy and Will Crenshaw will be the Gala Chairs this year and the CHRISTUS Southeast Texas Foundation is excited to be spotlighting two community members: Jim Willis as the Legacy Award Recipient and Dr. Robert Birdwell for his decades of service.

“We are excited to offer the community a night of stellar entertainment with Little Big Town. They span musical genres with their country foundation and pop influenced music. We pride ourselves on throwing the biggest party of the year, and I know we will live up to that promise again at this year’s gala,” said Ivy Pate, Foundation President.

With the end of the year just around the corner, now is an excellent time for you to review your charitable contribution. You might want to make a list to ensure that you have taken full advantage of all of the tax saving deductions available to you. Here are some ideas for year-end planning that can help support our cause and benefit you.

With the end of the year just around the corner, now is an excellent time for you to review your charitable contribution. You might want to make a list to ensure that you have taken full advantage of all of the tax saving deductions available to you. Here are some ideas for year-end planning that can help support our cause and benefit you.

Held at the Beaumont Country Club, this year’s Golden Pass LNG Swinging for a Miracle Golf Tournament was a hole in one, with businesses and organizations from all over the community coming together to golf for two great causes: Children’s Miracle Network Hospitals and the CHRISTUS Southeast Texas Foundation.

Held at the Beaumont Country Club, this year’s Golden Pass LNG Swinging for a Miracle Golf Tournament was a hole in one, with businesses and organizations from all over the community coming together to golf for two great causes: Children’s Miracle Network Hospitals and the CHRISTUS Southeast Texas Foundation. Congratulations to our winners!

Congratulations to our winners!

Walmart associates in West Orange rolled up their sleeves and participated in Fundraising Friday. Each Friday, they hosted a different fundraiser for CMN Hospitals. One day, they took turns selling popcorn to associates and customers. Another day, they cooked up savory links and served them in the break room with ice cold drinks for a $5 donation. Associates were thrilled to participate knowing their hot meal helped kids at CHRISTUS Southeast Texas St. Elizabeth and Jasper Memorial.

Walmart associates in West Orange rolled up their sleeves and participated in Fundraising Friday. Each Friday, they hosted a different fundraiser for CMN Hospitals. One day, they took turns selling popcorn to associates and customers. Another day, they cooked up savory links and served them in the break room with ice cold drinks for a $5 donation. Associates were thrilled to participate knowing their hot meal helped kids at CHRISTUS Southeast Texas St. Elizabeth and Jasper Memorial.

Bridge City associates got creative by making a wishing well at the front of the store. They posted a sign inviting customers to “toss a coin and save a life.”

Bridge City associates got creative by making a wishing well at the front of the store. They posted a sign inviting customers to “toss a coin and save a life.” A pediatric patient at CHRISTUS Southeast Texas St. Elizabeth was feeling uncomfortable and withdrawn after receiving an NG tube in her nose to help her get better. Her stress levels were high and she was not healing as quickly as doctors expected. Thankfully, St. Elizabeth’s Certified Child Life Specialist, Ashley Bares, came to the rescue.

A pediatric patient at CHRISTUS Southeast Texas St. Elizabeth was feeling uncomfortable and withdrawn after receiving an NG tube in her nose to help her get better. Her stress levels were high and she was not healing as quickly as doctors expected. Thankfully, St. Elizabeth’s Certified Child Life Specialist, Ashley Bares, came to the rescue. The CHRISTUS Southeast Texas Foundation recently purchased a Panda Warmer for the Center for New Life, the Labor and Delivery Unit at CHRISTUS St. Elizabeth Hospital. This purchase is part of an overarching project with the goal of outfitting the Center for New Life with a total of 19 Panda Warmers (one for each of the 19 Labor and Delivery Rooms). To date, the Foundation has already raised funding for nine Panda Warmers.

The CHRISTUS Southeast Texas Foundation recently purchased a Panda Warmer for the Center for New Life, the Labor and Delivery Unit at CHRISTUS St. Elizabeth Hospital. This purchase is part of an overarching project with the goal of outfitting the Center for New Life with a total of 19 Panda Warmers (one for each of the 19 Labor and Delivery Rooms). To date, the Foundation has already raised funding for nine Panda Warmers. The CHRISTUS Southeast Texas Foundation (Foundation) is proud to announce major medical equipment additions to the Mamie McFaddin Ward Cancer Center and to the Cancer Floor at CHRISTUS St. Elizabeth Hospital. For the past several years, the Foundation has worked with local foundations and individual philanthropists to update these cancer care centers with state of the art equipment to offer the best in cancer detection and treatment.

The CHRISTUS Southeast Texas Foundation (Foundation) is proud to announce major medical equipment additions to the Mamie McFaddin Ward Cancer Center and to the Cancer Floor at CHRISTUS St. Elizabeth Hospital. For the past several years, the Foundation has worked with local foundations and individual philanthropists to update these cancer care centers with state of the art equipment to offer the best in cancer detection and treatment.